Upstart stands out among hyper growth

There are many deep dives on UPST. Below is the most comprehensive one I came across.

I will not repeat what upstart does etc. I hope to add some incremental insight to the UPST discussion.

UPST background: COVID casualty & mistimed IPO

While most high growth stocks were COVID beneficiaries, UPST was not. UPST growth suffered due to COVID. UPST only product was personal loans in 2020 and most of 2021. As seen below, total consumer personal loan outstanding in US collapsed in 2020 due to COVID. It only started to recover in Q2 2021.

UPST IPO was in Dec 2020 which was almost the worst possible timing. UPST growth had decelerated into IPO on the shrinking industry backdrop.

UPST revenue growth YOY

2018 +73%

2019 +65%

2020 +42%

Its incredible that UPST grew in 2020 when personal loans outstanding collapsed. Upstart platform flywheel was gaining stream, and they gained significant share in 2020 shrinking market.

Growth broke out in Q2 2021 when US personal loans outstanding starting to grow again.

UPST saw 67% sequential QoQ growth in Q2 2021. UPST is expected to see FY 2021 growth at +245% YOY.

UPST massive Q2 2021 beat released on 11 Aug 2021 triggered the big move in the stock from $135 to almost $400.

This move has been fully reversed with the selloff in growth stocks while personal loan outstanding continues to grow as COVID fades & UPST continues to gain market share.

Where does UPST stand now

1)Its cheap:

Mistimed IPO + acceleration of business + sell off with growth stocks = cheapest growth stock

UPST right now is one of the cheapest stocks in the market relative to its growth.

Below is excellent tread on growth stock valuations vs growth. Im reproducing some charts here. UPST stands out.

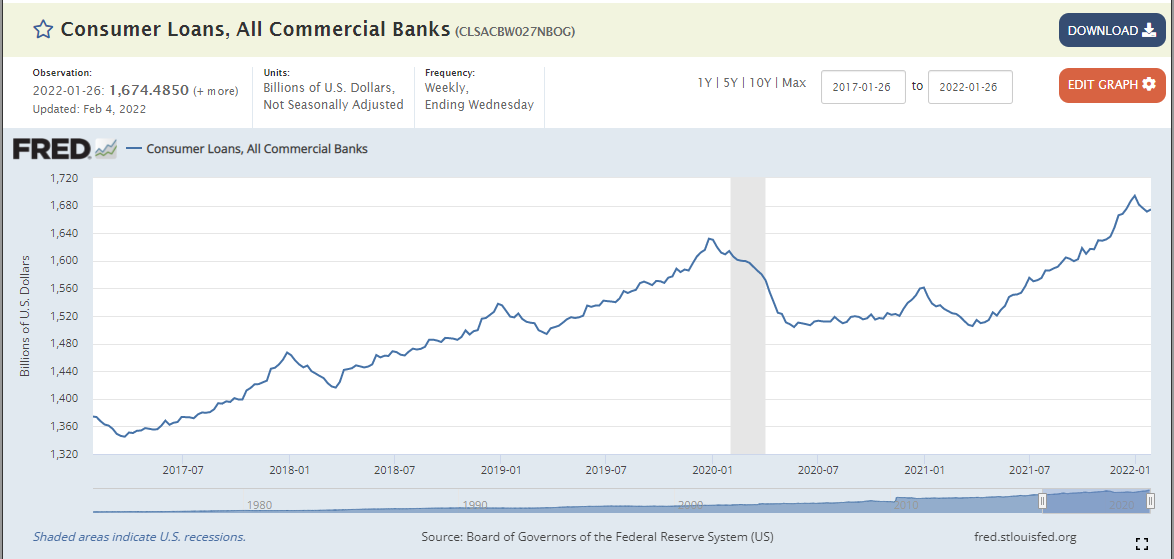

2)Consumer loans return to long term trend growth:

The recovery in consumer loans continues which is a tailwind for UPST unlike many growth stocks which where COVID beneficiaries & face drag.

The above chart includes auto loans (in additional to personal loans) which will be a growth driver for UPST in 2022.

The above chart is updated weekly and is available here.

https://fred.stlouisfed.org/series/CLSACBW027NBOG

The seasonally adjusted long-term chart of consumer loans outstanding below. The 2020 dip is comparable to GFC dip. Otherwise, it nicely trends up in long-term. This provides a great runway for UPST. There is a lot of noise about higher interest rates, worsening delinquency etc will impact UPST. As seen below, only severe shocks like GFC & COVID disrupts the uptrend in consumer loans outstanding (everything else is just noise).

Source:

https://fred.stlouisfed.org/series/CLSACBW027NBOG

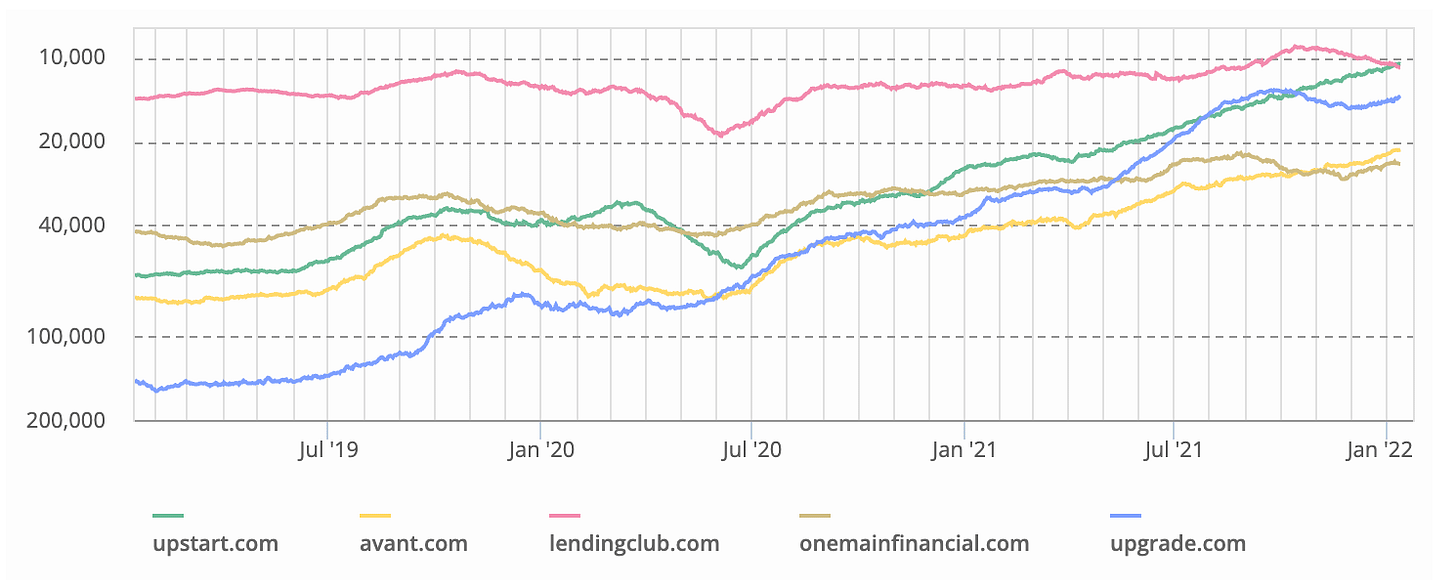

3)UPST continues to gain market share

Majority of UPST personal loans is originated via upstart.com & website traffic gives an excellent indication of business trends. Alexa website traffic rank data shows UPST gaining market share in 2020-2021 & continues to gain market share.

The charts below show Alexa website traffic rank data for 3years and 6months vs competition. Recent data shows UPST has overtaken LendingClub in website traffic.

4)UPST enters new business lines in 2022

UPST will enable auto loans to all auto dealers using “Upstart Auto Retail” platform in early 2022. Auto loans will be significant business line in 2022 propelling growth.

Source:

UPST will also start offering small dollar loans and business loans in 2022.

Bottomline

UPST is

-Cheapest hyper growth stock

-With short-term & long-term industry tailwind

-Gaining market share in core

-Entering larger adjacent business lines