AXL is a global Tier 1 supplier to the automotive industry. AXL manufactures, engineers, and designs axles, driveshafts, and transmission shafts, mainly for light trucks and SUVs, but also for cars and crossover vehicles. The Tier 1 supplier gets more than 35% of its business from GM. Other customers include Ford, Mercedes-AMG and Geely Auto Group. AXL operates nearly 80 manufacturing facilities around the world and generates 80% of its revenue from North America.

Backdrop

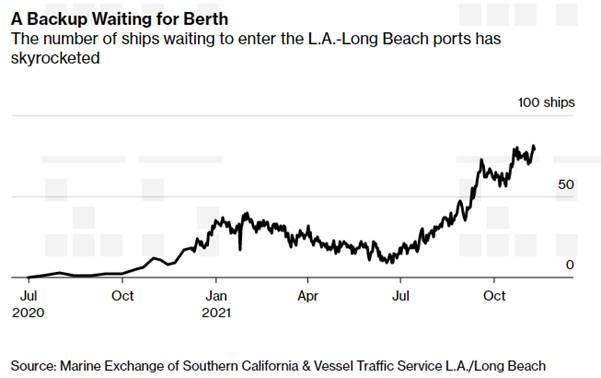

COVID lockdowns, port closures, quarantines etc across the world has disrupted global supply chains. This is evident from congestions seen across global ports. For example, number of ships waiting to enter the key US container port is at all-time high.

Supply chain disruptions have hit US auto industry particularly hard. Auto producers had to shut down plants as they couldn’t get supply of semiconductor chips which go into vehicles.

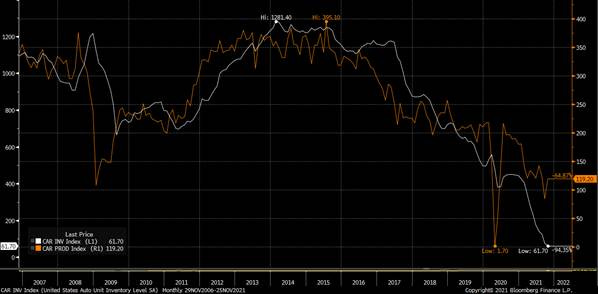

US auto production (orange) suffered and current auto production is around the lows seen during heights of the global financial crisis in 2008. US auto inventory situation is much worse. As US economy rebounded in 2021, auto sales rebounded (without production recovery) drawing down auto inventory (white) to an extreme record low.

Auto demand with extremely low new auto inventory made used vehicle values surge.

Looking ahead

I expect supply chain disruptions to ease somewhat post US holiday season and to recover further progressively in 2022. Auto sector is already seeing better supply.

GM said recently "In fact, the week of November 1 represented the first time since February that none of our North American assembly plants were idled due to the chip shortage"

Source

https://www.reuters.com/business/autos-transportation/gm-says-seeing-better-flow-semiconductors-2021-11-10/

Toyota said recently “December is the first time in seven months that all of Toyota’s production lines in Japan will be operating normally"

Source

https://www.bloomberg.com/news/articles/2021-11-12/toyota-december-production-outlook-shows-easing-supply-woes

Multiyear auto production up cycle

The setup is ripe for multiyear production upcycle in US auto industry to refill inventory. Post global financial crisis, the cycle lasted about 5 years. Now the inventory is less than half of the lows of global financial crisis and thus the upcycle should be longer.

AXL is a cheap way to play this upcycle. AXL had $0.46bio free cash flow in the past 12 months. Its trading 2.4 times cash flow at current market cap of $1.11bio. if you look at free cash flow over the past few years, its trading at about 4 times average free cash flow. AXL is the cheapest stock in the auto OEM space based on free cash flow.

I expect AXL enterprise value to recover closer to $4.5bio pre covid valuation once supply chain clears up given the multiyear production upcycle potential. That implies over +50% upside in the stock.